Reserve Bank Of India

Overview:

| RBI Established: | 1 April 1935 |

| RBI Ownership: | Government of India |

| RBI Headquarters: | Mumbai, Maharashtra (India) |

| RBI Governor: | Shaktikanta Das |

| RBI Currency: | Indian Rupee (₹) |

| RBI Nationalisation: | January 1, 1949 |

What is RBI?

RBI or Reserve Bank of India is a central banking institution of India established on April 1, 1935, in accordance with the provisions of the RBI act. 1934. This act provides a framework for the supervision of the banking system in India.

RBI was nationalized on January 1, 1949, and after the nationalization of RBI, it is entirely owned by the government of India, but before the nationalization of the RBI, it was entirely owned by the private shareholders.

RBI Headquarters:

The central office of the RBI was initially established in Kolkata (formerly Calcutta) but was permanently moved to Mumbai in 1937.

The RBI also has 4 local offices in Mumbai, Kolkata, Chennai, and New Delhi. RBI also has 27, regional offices most of them in the state capitals. These local and regional offices are to advise the central board on local matters and to represent territorial and economic interests of local cooperative and indigenous banks.

Indian Currency:

The RBI issued the Indian Rupee Notes except one Rupee Note. According to the RBI act. 1934, The RBI can issue the Indian Rupee Notes of RS.2 and all the Notes greater than Rs.2, and maximum it can issue the Note of Rs.10,000. The RBI Notes Printing Presses are situated in the Indian cities Mysore, Salboni, Dewas, and Nashik.

The Government of India issues the 1 Rupee Note and all the Indian Rupee Coins. According to the Coinage act 2011, the GOI can issue a maximum of 1000 Rupee coins. The Mints (where the Indian Rupee coins produced) of the Government of India are situated in the Indian cities Mumbai, Kolkata, Hyderabad, and Noida.

The Preamble of the RBI:

“To regulate the issue of banknotes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage, to have a modern monetary policy framework to meet the challenge of an increasingly complex economy, to maintain price stability while keeping in mind the objective of growth”.

Central Board of the RBI:

The Reserve Bank’s affairs are governed by a central board of directors, and the board is appointed for a period of four years. The board is appointed by the Government of India, according to the RBI act. There are 1 Governor and a maximum of 4 deputy Governors appointed as official directors. There are 10 directors from various fields, 2 Government officials, and 4 directors for local boards, one for each.

RBI Objectives:

RBI regulates and supervises the financial and payment system in India.

RBI ensures financial stability in the banking system in India.

RBI manages the foreign exchange in India.

RBI issue the currency in India and destroys the currency if not fit for circulation.

What is Policy Rates and Reserve Ratios?

Repo Rate:

The rate at which the RBI lends money to the commercial banks against the government securities is called Repo Rate.

Whenever banks face a shortage of funds, they can borrow from the RBI as per the Repo Rate and against the pledge of Government securities.

In this case, the commercial banks borrow money from the RBI by selling the securities and bonds with an agreement to repurchase the securities on a certain date at a predetermined price.

Repo Rate is the short form of Repurchase Rate.

It is always higher than the Reverse Repo Rate.

Mostly it is used to control inflation.

Generally, these types of loans are for a short duration, from 2 days to 90 days.

Example: If the repo rate is 6% and any bank borrows Rs.1000 from the RBI, the bank will pay Rs.60 as an interest to the RBI.

Reverse Repo Rate:

The rate at which the RBI borrows money from the commercial banks is called Reverse Repo Rate.

Whenever banks have surplus funds but don't have any other lending or investment options, they can deposit the surplus funds to the RBI and earn interest as per the Reverse Repo Rate.

Mostly it is used to control the money supply.

Example: If the reverse repo rate is 5% and any bank deposits Rs.1000 to the RBI, the bank will earn Rs.50 as interest from the RBI.

Bank Rate:

It is the rate of interest charged by the central bank on the loans they have extended to commercial banks.

The bank rate is usually higher than the Repo Rate as it is an important tool to control liquidity.

It is similar to the Repo Rate, but in this case, there is no repurchasing agreement signed and no securities sold.

Generally, these types of loans are for a long duration, from 90 days to 1 year.

Cash Reserve Ratio (CRR):

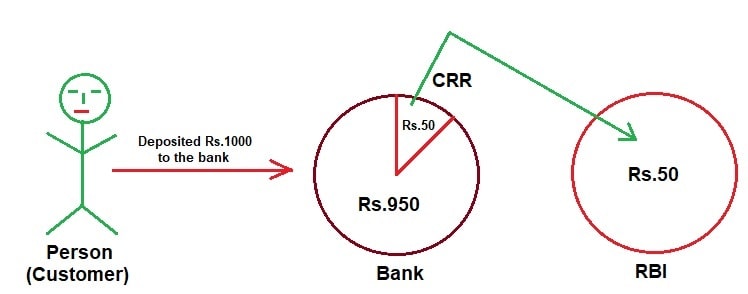

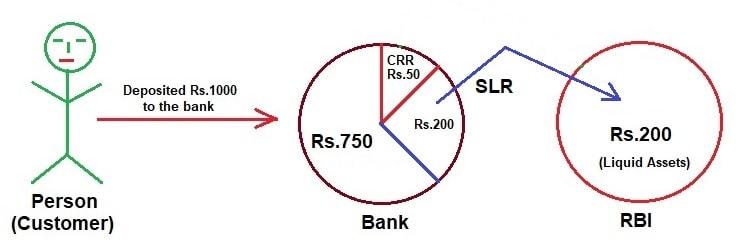

It is the fund that banks have to maintain with the RBI at all times. In other words, banks have to maintain a certain percentage of funds of the total deposits in the current account with the RBI. RBI uses the CRR to drain out the excessive money from the system. Banks don't earn interest on this money.

Example: If a person deposits Rs.1000 in a bank and if the prevailing CRR is 5% then, the bank has to deposit Rs. 50 in the current account of RBI and the bank is left with Rs.950. The bank can not use that deposited amount of Rs.50 to the RBI for its commercial purposes.

Statutory Liquidity Ratio (SLR):

Apart from the CRR, the banks have to maintain a percentage of their deposits as liquid assets in the form of gold, cash, and approved securities from the central government or state governments of India. This percentage is known as SLR. Here, banks earn interest on liquid assets.

Example: If a person deposits Rs.1000 in a bank and if the prevailing SLR is 20% then the bank has to maintain liquid assets of Rs.200 in the form of gold, cash, and government-approved securities.

MCLR (Marginal Cost of Funds based Lending Rate):

It is the rate of interest at which the banks lend money to their customers. The lending rates under MCLR are different for loans with different tenors. Usually, the MCLR is revised every month.

The MCLR replaced the base rate system with effect from April 1, 2016.

Under the MCLR, the calculation of interest rates are based upon-

1. The marginal cost of funds

2. Negative carry on account of CRR

3. Operation costs of banks

4. Tenor premium